Machine Learning and RoAS in digital advertising

It is no news that the speed of technological change we are experiencing is a great challenge for companies. Adapting to this, keeping the talent in your company up to date and making efficient use of resources are increasingly challenging tasks.

From Boomit – Growth Marketing we accompany the development of digital products working as strategic partners with our clients.

Being partners means that we align with their structure, teams, and specialists they already have, to add technological capacity and talent that we’ve been developing for years for the healthy growth of these types of applications.

At Boomit, we study the business opportunity and if we understand that there’s good synergy between the company and our capabilities, we take on the challenge and assume risks. These risks are crucial as they align the objectives of our partner with ours. It’s truly a recipe that doesn’t fail.

In this article, we’ll tell you the key to success from a Growth Marketing perspective for Apps.

What will you learn in this article?

1. What is Machine Learning (ML) in a Digital Marketing strategy based on data, and why it is so important to have an expert team in this.

2. How to automatically feed Machine Learning (ML) with RoAS data to align business health with advertising strategy align business health with advertising strategy.

3. How to do LTV (Lifetime Value) modeling (Lifetime Value) and link it to your CAC (Customer Acquisition Cost).

The key to success

When we talk to digital product companies, we find different stages at the product level and in the maturity of the teams. Talent levels and areas of specialization are really varied, but there’s one area in particular that stands out as always a major pain point: “how to use data to make decisions, report, and optimize marketing strategy.”

It’s as if the entire marketing industry feels like it’s working blindfolded at a time in history when AI, Machine Learning (ML), and automation are the only way to survive and grow at the pace businesses need.

Within this complex reality, finance teams can’t connect their reports with marketing’s, marketing can’t do it with the product team, and the C-Level doesn’t know what data to look at or how on earth to read them to make decisions. Ultimately, they often don’t even know if the company is profitable or if it has a healthy projected cash flow.

Boomit was created as a company specialized in technology and consulting in Growth Marketing (Martech) to solve this problem.

Let us now begin to use slightly more technical language.

In a very simplified way, these are the 3 critical points that digital product companies cannot solve because of lack of capabilities, not having the right technology, and because talent in these areas is scarce or almost non-existent when one looks for it within the Digital Marketing sector.

The 3 critical points to solve:

- RoAS-oriented Machine Learning.

- Data connectors, tracking and centralized attribution

- Digital communication and creative based on scientific methodolog

What is is “RoAS-oriented Machine Learning”? ?

When we talk about Digital Marketing and Machine Learning (ML), in a very simplified way we can say that ML is the way in which today’s advertising platforms manage to understand how and to whom to show their advertising message.

The good news is that these ML computational algorithms work very well when we send them the signals correctly and at the minimum indicated rate (i.e., sufficient amount of data in a given period of time). The bad news is that sending you the right signals is often a huge challenge for companies and marketing teams.

In order to send the signals correctly, we must follow these steps:

- Correctly define which signals you should feed the ML with.

- Perform the correct configuration for sending data between these systems.

- Achieve the minimum speed required in sending this data for the ML to work (in general in this area of marketing we achieve this with the right amount of advertising investment).

That’s it, by following these steps we will be able to get the most out of the ML of the advertising platforms.

Now how do we introduce the word RoAS to the ML conversation?

Most of the time we observe that the marketing strategies of digital product companies are based on optimizing the acquisition cost of each new user, and in some cases we also see a retention strategy. So far, so good! But if we only observe this, we fall into what we at Boomit call “the CAC trap”.

Suppose we have an App like Amazon whose goal is to acquire buyers and sellers. This means that on the one hand we must develop a strategy to acquire companies that want to sell in the Marketplace, and on the other hand a strategy to bring buyers interested in the products that sellers want to sell.

To simplify this example, let’s first focus on this second part: acquiring buyers on Amazon.

What would the ACC be in this example? Well, we could say that it is a user who:

- Download the application

- Your account is created

- Makes your first purchase on Amazon

So, for our example the CAC is the Cost of acquiring a customer that follows these three steps.

Do you see a problem with this?

You should!

If we orient all Machine Learning (ML) only towards the CAC, we will tell the ML that we are only interested in people who follow these 3 steps.

This can bring us many problems, since for the business to be viable, we not only need users who make their first purchase, but we need loyal users who continue to buy and with a certain profile that then makes their retention viable over time, increasing their LTV (Lifetime Value) and allowing that user to be profitable for Amazon.

Taking this same reasoning to the case of seller acquisition, if we target only CAC we will bring users who may create their Amazon store very quickly but who do not know how to sell or who do not give enough importance to their venture…

In the end, blinded by a low acquisition cost, we may be bringing in low-value users, destroying the health of the business.

The highest point of profitability in the business is usually not found when we obtain the lowest possible CAC, but rather at a value greater than that apparently ideal minimum.

Do you see where the conversation is going?

In the example, we are missing signals! We are telling the ML to look for the wrong people!

To find the right people it is key that we feed the ML algorithms of the advertising platforms with CAC signals, but also RoAS, Revenue, or purchase frequency, among others.

With this covered, we can start looking at the CAC KPIs and compare it to the projected RoAS of the users we are acquiring on a daily basis.

This is another challenge that we will introduce to you next.

RoAS and projected LTV

Once we know that Machine Learning is making decisions according to the company’s business objectives, in order to know if our CAC is adequate, we need to use Life Time Value (LTV) predictive models. These predictive models will allow us to understand how profitable our marketing strategy is being in terms of CAC, that is, our acquisition costs.

How do we do this?

At Boomit we have developed several methodologies to help our partners obtain reliable LTV projections.

The most common consist of predictive models that take into account the past and recent behavior of the customers we are acquiring. Then, each strategic proposal is analyzed and judged based on how we are projecting that net LTV against the evolution of the CAC we are obtaining.

These models must be constantly monitored and adjusted as they depend on multiple variables.

For this article we will describe one of these projection methodologies, but it is important to understand that an analysis of your company’s data is required in order to choose the methodology for calculating these predictive models.

Cumulative ARPU methodology

LTV can be read as the sum of revenue per user over time. So this model is based on taking the revenue values given by a certain cohort of users that we wish to study, and with those points calculate the most approximate possible function that allows us to project the future.

In general for this method we use a logarithmic function:

F(t)=A*ln(t+B)

F(t) – value accumulated by a user over time

t – Number of days of user’s life

A and B. are the constants that will define the approximation of this function to these known points, and therefore will also define the Revenue that these users will leave us as time goes by.

In order to make a good projection it is necessary to take some important precautions:

– Data curation for the sample

– Classification of sets of users for which we consider that we should take different LTV curves (e.g., incentivized users vs. natural users).

– Minimum amount of data to give statistical validity to the approximation.

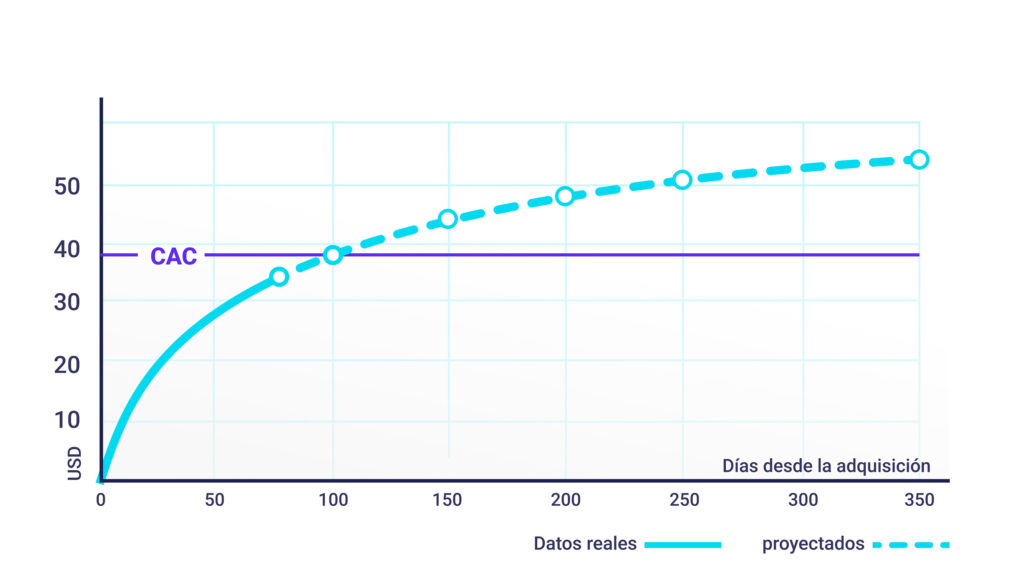

Once we get our projection, what we will do is cross-reference it with our current customer acquisition cost (CAC). This will give us as a result a measure of the time in which we will recover the investment.

Look at the following graph showing a projection curve of a customer’s value and its crossing with the CAC we are currently obtaining. For this example we see that after 100 days we reach the break-even point in which our user costs us the same as the profit he will leave to the company.

It will be the task of the finance team to indicate to us what is the CAC repayment time that the business requires according to the shareholders’ vision, competitive factors and future value of the customer base.

Making a healthy acquisition and retention strategy for your business is an art that requires knowledge in marketing, communication, data analytics, statistics and machine learning.

At Boomit we work with expert teams in these areas so that our partnership with clients allows them to transform their business with cost clarity, aligning and connecting marketing, product, operations and finance teams in a single objective.

If you are interested in adding these capabilities to your company, let’s talk, maybe we can be partners.

Copyright © 2023 Boomit.

All rights reserved. MOSEYA SA / 1011 Cassinoni , Montevideo, 11300, Uruguay / 12550 Domus Global Services LLC

/ Biscayne Blvd., Suite 406 North Miami, Florida.